In March 2024, I’ve made a decision that some of nigelchua.com content is exclusively available to my mailing list subscribers. These exclusive content will never be re-used, recycled or republished – these are exclusive now and in the future.

If you enjoy reading my ramblings, you’ll need to scroll down the page to subscribe to the list. Subscription boxes are available at the newsletter (this) page, as well as at the top and bottom of posts and articles.

Why send these emails?

Firstly, writing these emails help me brainstorm – my readers help serve as a mental sounding board (like a board of directors and close friends) to bounce and refine ideas. As I come up with ideas, I run it through my head in the form of an imaginary email to this mailing list and wonder how readers may respond. Then I thought, why not just type it out for real?

Secondly, I want to help more people and especially my readers who sign up to be on my mailing list – I’ll share exclusive ideas and information that may help you earn / save / invest and grow more, whatever your personal goals are in your current season of life.

Thirdly, writing about ideas and new projects may also help with accountability.

Lastly, but not least – I often get GREAT feedback to these emails – there’s an entire community of great publishers, thinkers, growth and financial independent retire early peeps out there, and this is one of my way to keep in touch with you all.

What’s in it for you?

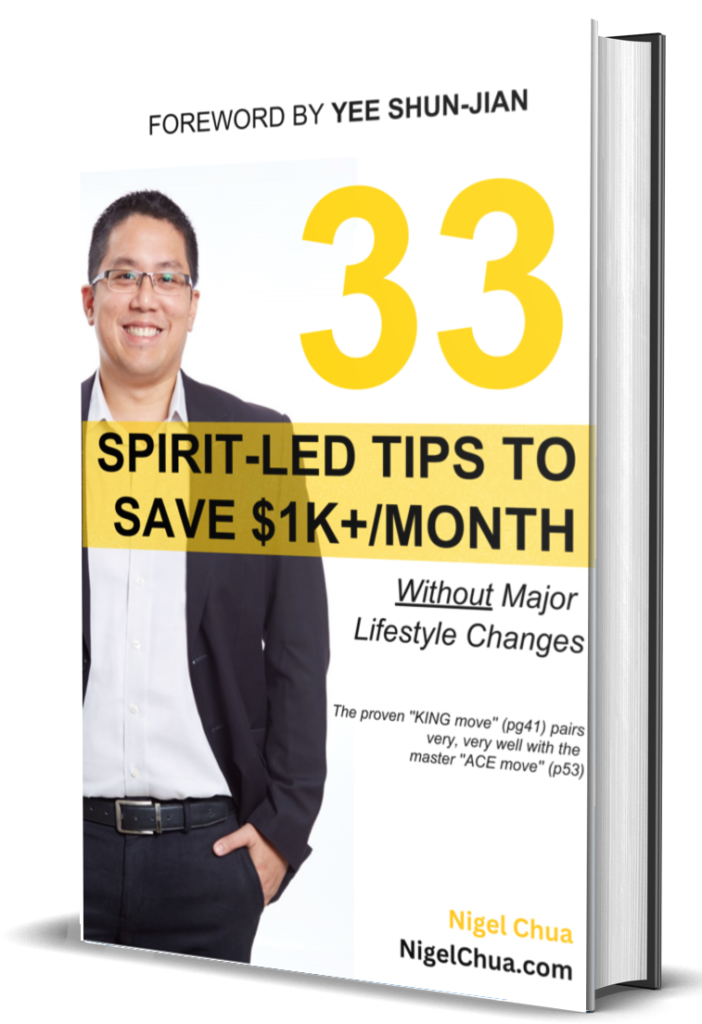

A download bonus for you is a free eBook I personally wrote called 33 Spirit-led Tips To Save $1K+/month (based on my personal tried-and-tested tips over years of testing) which you’d get when you join the mailing list

Other than the my free ebook, you’d get an honest peek into how I approach various aspects of winning the game of life, specific to personal growth and finance (especially into financial independence and retiring early) as well as other stuff that intrigues me.

Oh yeah, and an email relationship with me.

Hopefully, the brainstorming and emails will be mutually beneficial – see you on the inside =)

Join the mailing list today

Some updates are exclusive to the list and won’t show up on the blog ever.

Notes:

- You agree that when you sign up above, you will be added to a marketing mailing list where you will receive personal growth and finance (financial independence retire early) tips and promotional offers.

- You’ll have to confirm your subscription to join the list. If you do not see the confirmation in your inbox, check your spam, junk or promotions folder.

- Your free ebook will be sent to the email you submit above.

- Your privacy is 100% safe and you can opt-out at any time, for any reason, immediately, and without hassle.

- I try my best to personally read and reply all emails =)

NO THANKS — Go to the website and read 1000+ pages of personal growth & personal finance tips.